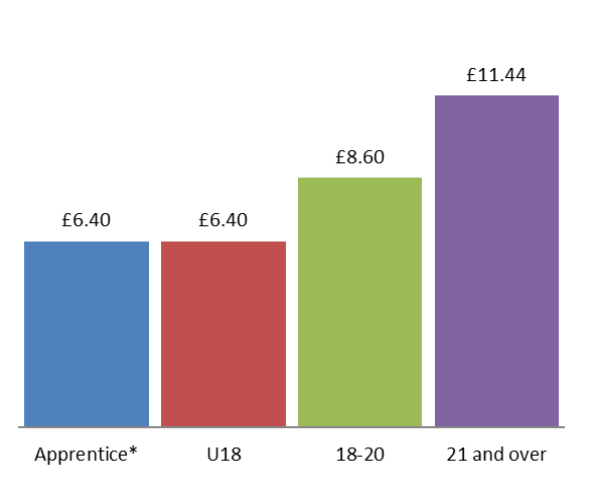

National Minimum Wage rates will increase in April, and staff aged 21 and over are now brought into the top band. The hourly rates for 2024 are:

Apprentice* U18 18-20 21 and over £6.40 £6.40 £8.60 £11.44 *If under 19 or in first year of apprenticeship (otherwise refer to age bands).

Statutory Sick Pay increases from £109.40 to £116.75 per week.

Parenting pay (maternity, paternity, adoption pay) rises from £172.48 to £184.03 per week.

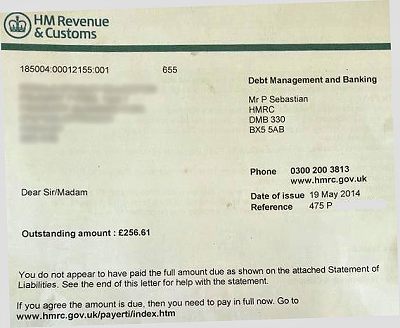

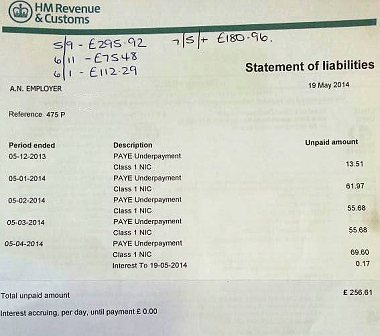

Whether you run your own payroll or outsource it to a specialist, as an employer the buck stops with you. So it’s important to know your responsibilities.

Whether you run your own payroll or outsource it to a specialist, as an employer the buck stops with you. So it’s important to know your responsibilities.