Had a letter from HMRC’s Debt Management division? Don’t blindly pay it.

So far this week, 3 of our clients have called us about letters from HMRC telling them they owe £100s.

All complete nonsense.

And it’s only Tuesday <sigh>.

1. Check what you should have paid

Ask your payroll provider for a P32. This is simply a list of all the payments that you should have made to HMRC.

For example:

| Pay Period | Amount Due to HMRC for Period |

| Quarter 1 total | 295.92 |

| Quarter 2 total | 75.48 |

| Quarter 3 total | 112.29 |

| Quarter 4 total | 180.96 |

| Year Total | 664.65 |

2. Check what you did pay

This means going through your bank statements and finding every payment to HMRC. Note how you paid it: online, cheque, debit card etc. Note down the date that the money left your account and the amount paid.

The total of all your payments should be the same as the Year Total on the P32.

If it’s not, then you either overpaid or underpaid somewhere along the line. Work out when and where.

3. What to look for

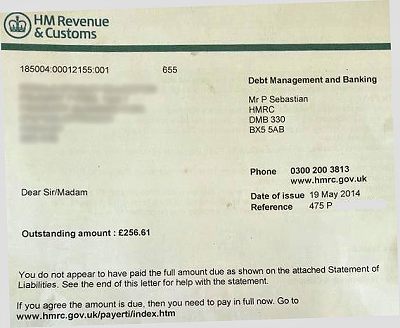

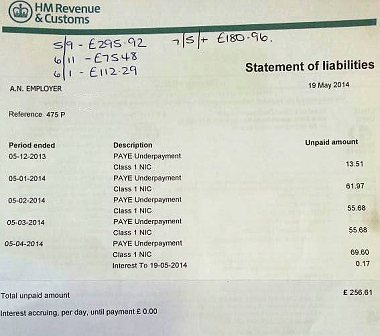

Page 2 of the letter is the statement of liabilities – pictured below. Look at the total unpaid amount. Sometimes it’s obvious that a payment has gone astray – if your cheque for £45.32 hasn’t cleared, and the statement says you owe £45.32, job done. Others take a bit of investigating.

Dates are key. I can’t stress that too highly.

Late payments cause the most common problem. When you pay late, HMRC will allocate the payment to the wrong period.

For example, look at the handwritten notes below. You can see that our client pays PAYE quarterly. So he made 4 payments, which each match the P32 above.

But now focus on when those payments were made. £180.96 was paid on 7 May. Not only was that late – it should have been paid by 19 April – but critically it was the last payment for the 2013/14 tax year.

Paying it late meant that HMRC automatically took it into the 2014/15 tax year.

4. Do your sums

To check your payments, first knock off any interest that HMRC have added, because the payments you are looking for obviously don’t include that.

So we’re actually looking for £256.61 minus 17p interest = £256.44

We’ve figured out from the payment dates that £180.96 must have been allocated to the new tax year. That leaves £75.48. Ring any bells?

Yep, it’s the payment made on 6 November.

5. Call HMRC

This is usually the painful bit, involving a good 20-minute wait to speak to someone. But funnily enough, when you ring Debt Management division, you often get through straight away.

The first thing they ask is, “Are you making a payment?”

This is where you laugh and say, “No, cos I don’t owe you anything.”