As an employer, you may have heard something about the Employment Allowance, but what’s it for and how do you get it?

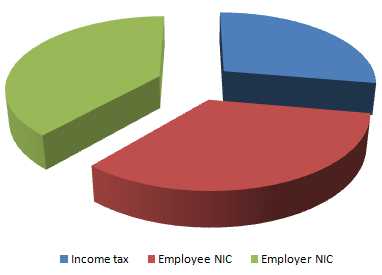

First, a bit of background. The PAYE you must pay to HMRC has three components: (1) the income tax and (2) the National Insurance Contribution (NIC) that you deduct from each employee’s gross pay, plus (3) a NIC that comes from the employer.

To encourage job creation, the Employment Allowance was introduced to help toward the latter – the green piece of pie.

It effectively allows you to underpay the employer’s NIC. From 6 April 2025 the EA covers up to £10,500 in a tax year.

Many small employers no longer pay any National Insurance at all. Yay!

A couple of examples:

Each month, Medium Size Co Ltd pays employer NICs of £2000.

- In April the Employment Allowance will knock £2000 off their PAYE bill.

- In May, June, July and August, they’ll also save £2000 a month.

- In September, they’ll save £500.

That’s the whole £10,500 Allowance used up, so from October, they’ll pay the full £2000 again.

On the other hand, Teeny Tiny Co Ltd only pays employer NICs of £40 per month.

So their total claim for the year is £480.

Eligibility

- A limited company where the director is the only employee paid above the NI Secondary Threshold (£5000 pa) doesn’t qualify.

- You won’t qualify if most of your work fulfils public sector functions – e.g. rubbish collection, NHS services.

- You won’t qualify if you employ someone for personal or household work – e.g. gardener, nanny – unless they’re a care or support worker.

How to Claim

If you use a payroll agent they should take care of this. Otherwise, you’ll need to use your own payroll software or HMRC’s Basic PAYE Tools to file an Employer Payment Summary (EPS) every tax year, telling HMRC you are using the Allowance to cut your payments.

Things to watch out for

- If your company belongs to a group of companies, only one can claim the allowance.

- If a company has control of another company, or both companies are under the control of the same person or persons, these companies are connected. Only one of the connected companies can claim the Allowance.

- You can only claim the Employment Allowance against one PAYE scheme even if your business runs multiple schemes.

Further information

Gov.uk overview and detailed guidance – the rules and regs

Historical

The Employment Allowance came into effect in April 2014. At the same time, employers ceased to be able to reclaim statutory sick pay. The Allowance has been increased multiple times, most recently and dramatically in April 2025.

| Apr 2014 | £2000 |

| Apr 2015 | £2000 |

| Apr 2016 | £3000 – restriction on director-only companies added |

| Apr 2017 | £3000 |

| Apr 2018 | £3000 |

| Apr 2019 | £3000 |

| Apr 2020 | £4000 – restriction on largest employers added |

| Apr 2021 | £4000 |

| Apr 2022 | £5000 |

| Apr 2023 | £5000 |

| Apr 2024 | £5000 |

| Apr 2025 | £10500 – restriction on largest employers lifted |

| Apr 2026 | £ |